How We Help

Managing money is tough. It can often feel like we’re doing everything we possibly can, yet with little success. We cut back on the things we enjoy and hold ourselves to account only to end up in the same position at the end of the month — frustrated, disappointed, and confused.

Whatever your goals — buying a new home, saving for a big purchase, getting out of debt — it’s completely achievable. You just need the right help, and that is what Spending Planners are all about - helping their clients to achieve their financial goals, not 10yrs from now, but often less than 10 months from now.

Watch the video to learn how we can help you better manage your money, get out of debt or save for your dreams.

If you have been doing everything right but your results are all wrong, a Spending Planner can most likely help you to achieve your financial goals without you having to feel like a scrooge or suffering untold sacrifices.

A Spending Plan has the power to resolve YOUR situation. If you have been trying hard to get money right, but you're not making progress and you're keen to find out why, you should request a chat with a Certified Spending Planner. They offer a no charge, no obligation, non judgemental call for anyone who is serious about changing their life for the better. Request a Free Call 1300 918 450

A Money Planning System That Works!

Money Problems come more from a lack of planning, than a lack of income.

- David Wright -

Finding yourself at the end of yet another month, having fallen short of your financial goals, is a terrible feeling. This is especially true when you’ve made sacrifices to get there and seem to have followed all the right steps, like cutting out unnecessary expenses and keeping to a budget.

But managing your money and hitting your saving goals isn’t just possible — it’s fairly easy when you know how. The problem isn’t that managing your spending is hard, or that you lack discipline. The problem is that most people have been taught to do it in completely the wrong way.

We can change that. Our Spending Planners are financial services professionals trained in providing for their clients what the school system failed to deliver. A simple, easy to use money system that puts money where they need it, when they need it, so they can live a stress-free financial life where money is a silent partner rather than a nagging dictator!

With a Spending Plan, when your Electricity bill arrives, the money to pay it with arrives as well. When your Insurance bill arrives, the payment money is there ready and waiting and it’s the same for all your other annoying but predictable bills.

A Spending Plan turns everything the right way up! Your money will tell you when a bill is going to arrive rather than the bill arriving, begging the question "where is the money?", and telling you that you are in trouble!

Ask yourself this important question… How can you get money right if you have never been taught what 'right' actually looks like or how to achieve it?

A Spending Planner coaches his or her clients in what they need to know to get it right once and for all!

Let's take a look at how they do that....

What is the Spending Planning Process?

Everything starts with you and everyone focuses on YOU.

Spending Planners offer a no-risk, guaranteed results, experience that will totally transform the way you manage and feel about money.

They can only help you by getting their hands dirty. They explain everything that they will do and what they are looking for from you in return.

Here's How it Works in 4 Simple Steps

Step 1: Book Your Free Call

Give our friendly money experts a call on 1300 918 450 or Request a Free Call to organise your no-obligation, free and confidential consultation. This is the first step towards your new life with far less, or quite possibly even no money stress, while still being able to set and achieve new and exciting financial goals.

Step 2: Speak with an Expert Spending Planner

An expert Spending Planner will give you a no-obligation, free call to get to know you and your situation. During the call the Spending Planner will listen carefully to understand where you are at. They will help you create a simple Spending Plan for some common basic expenses so you can see clearly how Spending Planning can be a game changer and how you can take control of money and choose your financial future rather than it just happening all out of control. If the Spending Planner feels you are someone they can help and you feel that Spending Planning will give a significant benefit, you will have an opportunity to proceed to the next step.

Step 3: Work with an Expert Spending Planner

At this point your Spending Planner will be clear on where you are at and what you want to achieve. They will show you how to use the available tools and services to leverage your Spending Plan to pay off any debt you might have, start setting new goals and achieving far more financially than you ever thought possible. Your Spending Planner will be focussed on teaching you new concepts and showing you how to use the Spending Planner software and other tools to successfully deal with all the situations that life may throw at you.

Step 4: Achieve Financial Success and Manage Your Money, Stress-free

With a comprehensive Spending Plan in place your Spending Planner moves into a mentoring role, regularly checking in with you to make sure your plan is working, you know how to follow the plan, and how to modify the plan if and when that might be needed. At the same time, they provide the accountability you need to stick to the plan until that becomes a normal part of your day to day (stress-free) life. Many clients call their Spending Planner for a chat and to brag about how well they are doing long after the official relationship ended.

If you wish your life were different… do your life differently.

-- Terence Houlihan --

Frequently Asked Questions

How Much Does It Cost?

Your initial call with one of our expert Spending Planners is a no-obligation and completely FREE consultation.

During the first consultation, the Spending Planner will work with you to understand your current financial situation, your financial goals and devise a Spending Plan that will help you achieve them.

Our Spending Planners exist to improve the financial literacy of anyone struggling to manage their money. Our goal is to set you up for financial success and work with you to achieve financial independence, helping you achieve your financial goals.

Give our friendly money experts a call on 1300 918 450 or Request a Free Call and organise your no-obligation, free and confidential consultation.

How Long Does It Take To Get Started?

When you're ready to get started we're ready to help make your financial dreams become a reality. The sooner you get started the sooner you can start seeing results with the Spending Plan that we'll help you devise and implement.

Most people see positive results almost immediately.

It may take some months to put your finances on an even keel, but creating a Spending Plan will allow you to see what needs to be done and how that will play out. For most people, seeing that light at the end of the tunnel and knowing that everything is going to be 'OK' is a very exciting experience.

If you get started today it should only be a few weeks before you are feeling much less stress and your feeling of self-worth is on the rise. In 6 months you won't know yourself!

Give our friendly money experts a call on 1300 918 450 or Request a Free Call and organise your no-obligation, free and confidential consultation.

Why Is A Spending Plan So Successful?

A Spending Plan helps you see into the future, allowing you to see the critical points where your money would have previously run out causing you heaps of stress. With the power of this 'crystal ball' view, you can then redesign your next 12 months and beyond so those critical points no longer present a problem.

It is not uncommon for an average family to find they have been allowing thousands of dollars to slip through their fingers on unimportant transactions and then by creating a Spending Plan, turn that money into a holiday or something else they would much prefer to do with it.

Of course it then also becomes a lot easier to factor in room for when that unexpected bill comes through the door, (which always happens when you least expect it), and to save for a great future and a much better retirement.

Give our friendly money experts a call on 1300 918 450 or Request a Free Call and organise your no-obligation, free and confidential consultation.

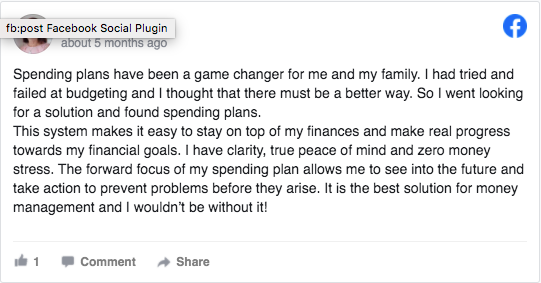

Customer Reviews

Annette Wisnewski

No More Late Fees or Interest Charges

Well 2 years ago I had a personal loan of $7,500 I was struggling to pay. I was 2 months behind in my rates and credit card payments. Then I discovered your program so no more late fees or interest charges on the credit card cause it's one day late. Keep up the good work.

Krystle & Jason

She Saved Our Family from Financial Ruin

Carolyn, my Spending Planner, is fantastic. In short, she saved our family from financial ruin. She went above and beyond to guide us to make wise financial decisions. Carolyn is non-judgemental and has a heart for people.

Conrad Scott

Two Weeks and Already I am Financially Better Off

I am very happy with the program. I am finally able to see my financial future and make appropriate plans. I have only been using it for two weeks and already I am financially better off (approx. $500). Being able to set goals and watch them become a reality is fantastic.

Karen Feibig

I now know how much I can realistically put away

I wanted to thank you for the program. For the last few years I thought I had plenty of money to put away into my savings but then I couldn't understand why every month or so I would need to spend those “savings” on bills! After using your software I now know how much I can realistically put away into my savings account and what is really needed for my day to day expenses. My husband and I are planning on having a baby this year and without your help, we never would have gained the knowledge that has allowed us to save for the arrival of our first child.

Hayley Summers

Isn't It Just Great to Reduce That Debt?

Your budget system has changed our lives... Just completely for the better! We now don't spend our money on crap but also know where it's going and we know how much we need to survive! The last time we spoke I think my partner needed to earn $1500 and myself $750... To live... Well now... He only needs to earn $1000 and myself $600! Isn't it just great to reduce that debt... I have paid off my personal loans I had and only have $7k left on the $18k loan we had for Chris, my partner. Have also paid out a credit card and only now have $2k to pay off go MasterCard (and we have 10k worth of savings) we have purchased secondhand older cars that are terrific and downsized... best of all my partner is now home and no more FIFO!

Keely

Thank You for Saving Our Finances and Relationship

Thanks so much for the (personal budget) software, I've finally taught my partner how important it is to look forward in our budget! When he saw that unless we stopped spending so freely now we'd be in hundreds of dollars of debt by Christmas his jaw dropped to the floor! It was the only way I could get him to realise how important it is to budget and put money away for emergencies (which I've done my whole wage-earning life, and have been trying to convince him for years!). So thank you for saving our finances and relationship!!! Thanks once again!

Creating your own personal Spending Plan will be one of the best things you ever did.

Request a Call From The Spending Planners Institute 1300 918 450