Eliminate Money Stress Forever with Spending Planning

How would you feel if you could get rid of your money worries once and for all? No more tossing and turning at night for hours on end. Instead, you could start waking up with a big smile on your face - knowing all of your bills and expenses for the next twelve months are covered. If you would like to experience what life is like when you don't have to worry or think about money stress all the time, then this is the most important post you will ever read. There's more than mere finances at stake here... I'm talking about saving your life. Did you know that financial troubles cause more than just stress? In fact, doctors now agree that financial stress is one of the most common causes of anxiety and clinical depression.

According to a recent research published on WebMD, financial stress can cause or worsen:

- Heart Disease/Attack

- Gastrointestinal Problems

- Weight Gain/Loss

- Eating Disorders

- Diabetes

- Insomnia

- Psoriasis

- Cancer

- High Blood Pressure

- Substance Abuse

Not to mention - money issues are also the number one cause for divorce and home violence in our society! But here's the surprising truth I've uncovered...

There Is An Easier Way!

Improving your financial state is a huge struggle for most adults on this planet. But once you learn what I'm about to show you — your days of struggle will be over.

“But if there's an easy solution... Why do so many people struggle?”

That's a good question — with a frightening answer. The truth is, most people struggle because every method they've been taught about managing finances is wrong. I'll say it again because it's important. Every single system you were taught — from your school teachers to pricey money “experts” — is wrong and dangerous.

Let Me Prove It To You

Here's a quick summary of what most people learn about managing their money:

1. Follow a budget

2. Deny yourself

3. Use a lot of guilt and shame to stay on track

You know what key component is missing here?...

Reality!

Let me give you a concrete example of the dire mistake everyone is making. Below I have two simple graphs that will profoundly alter the way you think about money. What we have here, is two families. Both families have identical incomes and follow the exact same budget without fail. (That means neither family made a single expense that was not budgeted for throughout the twelve months.) You would think that the two families — with their identical income and spending patterns — would do equally good (or equally bad), right? And from a budget point of view you would be right. Both families earn the same and spend the same - so the “bottom line” of the budget (income minus expenses) would look the same. But as you will now find out... One family met all of their expenses without missing a beat... And the other family ended up deep in the red.

Take a look at the graphs now. Each graph shows one family's bank account balance over the period of twelve months.

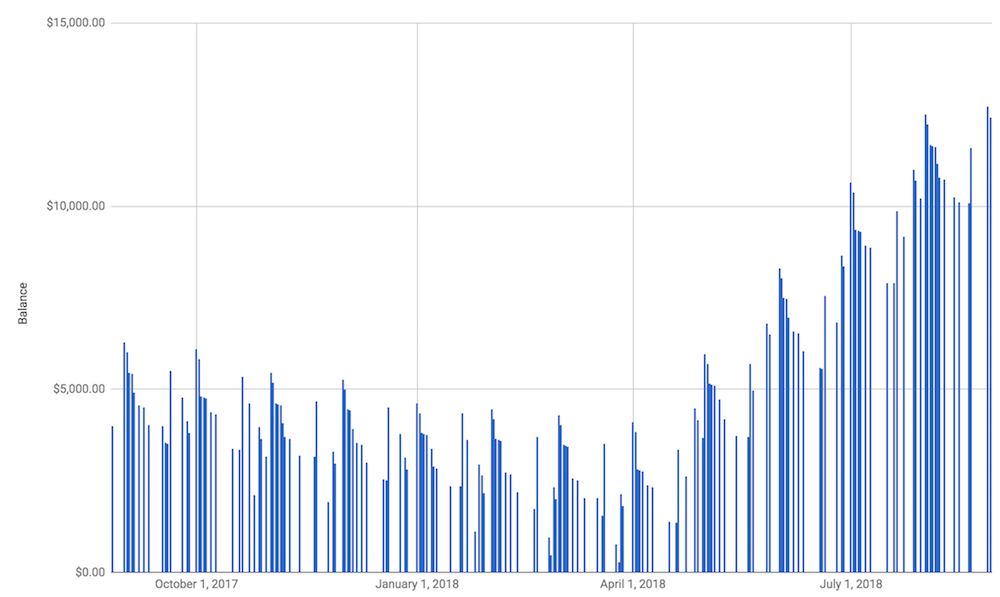

Family 1:

Identical income and budget, positive balance throughout twelve months and meeting all expenses Each bar shows a transaction that happened in the account (income received or expense paid).

As you can see - family #1 never had a negative balance.

But what about the second family?

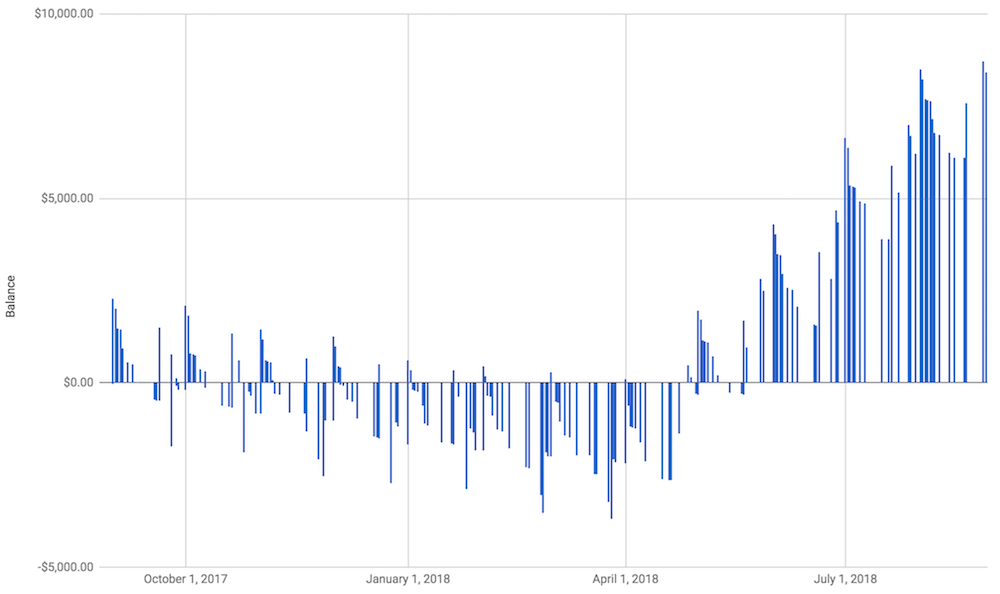

Family 2:

Identical income and budget, negative balance on many days throughout twelve months - unable to meet expenses without an overdraft Again, each bar shows a transaction that happened in the account (income received or expense paid).

But this time the graph looks different...

On multiple occasions throughout the year, family #2 had a deficit in their bank account. What's going on here?

How Can People Who Follow Their Budget End Up In Debt?

The answer in the case of these two families is simple: Because of their starting point. Family #1 had $2500 more in their bank account on the first day of the year than family #2. That was the only difference. But as you can see - it had a big impact... One that budgeting could not foresee. That's why budgeting can't answer even the simplest of questions: “If I stick to this budget, will I be able to pay all of my bills on time?” How would you feel if you were family #2, and your perfect budget still led you to debt? Frustrated? Stressed? Outraged? I'd feel all three! After all, if your budget gives you no certainty, what will? The answer is...

The Missing Number

If you look at the example above, you will notice I said that the only reason the same budget (for the same income) worked very well for family #1 but failed miserably for family #2 was the starting point. This starting point is part of what Certified Spending Planners call The Missing Number. This missing number is the reason most people struggle to meet their financial needs and aspirations. You can't find it in any budgeting system, app, or tools currently in the market. The developers of those tools seem to be unaware of its grave importance. In plain English, the missing number is the secret deficit that 99% of people are up against... without ever knowing it's there. The amazing thing is, once you know your missing number... almost any deficit becomes manageable. Here's how. Let's use family #2 as an example. Imagine you have just learned that you have a $2500 deficit, without which you will be unable to pay all your bills. Most people would freak out, start pulling their hair out, and wonder how on earth they could come up with that kind of money on short notice. But didn't I just promise you that “once you know your missing number, almost any deficit becomes manageable”? Lucky for family #2, they consulted with a Certified Spending Planner. And here's what they learned... After studying their finances, the Spending Planner identified one specific bill that was throwing family #2's entire plan off track. By splitting that one big bill into 6 smaller payments, family #2's immediate deficit dropped from $2500... to $80. And handling the long-term “catch-up” became easy, too: All family #2 needed to do (in addition to depositing $80 into their account,) was to increase their income by $135 a week for six months. Here's how they did it. The family decided that for those six short months, they would... Cancel their Spotify (music app) subscription (weekly savings: $3.50) Cut each kid's weekly allowance by $5 (weekly savings: $5 x 3 = $15) Reduce (but not give up completely) their takeaway dinners (weekly savings: $40) Give up the morning visit to the local coffee shop (weekly savings: $25 x 2 = $50) And... to work an extra 1.5 hours a week (earning $26.50 more) TOTAL: $3.50 + $15 + $40 + $50 + $26.50 = $135/week Would you agree that splitting one bill into six payments, cancelling a subscription to an entertainment service, eating a bit more at home and working 1.5 extra hours a week is within reach for anyone? And isn't it easier than coming up with $2500 on the spot?

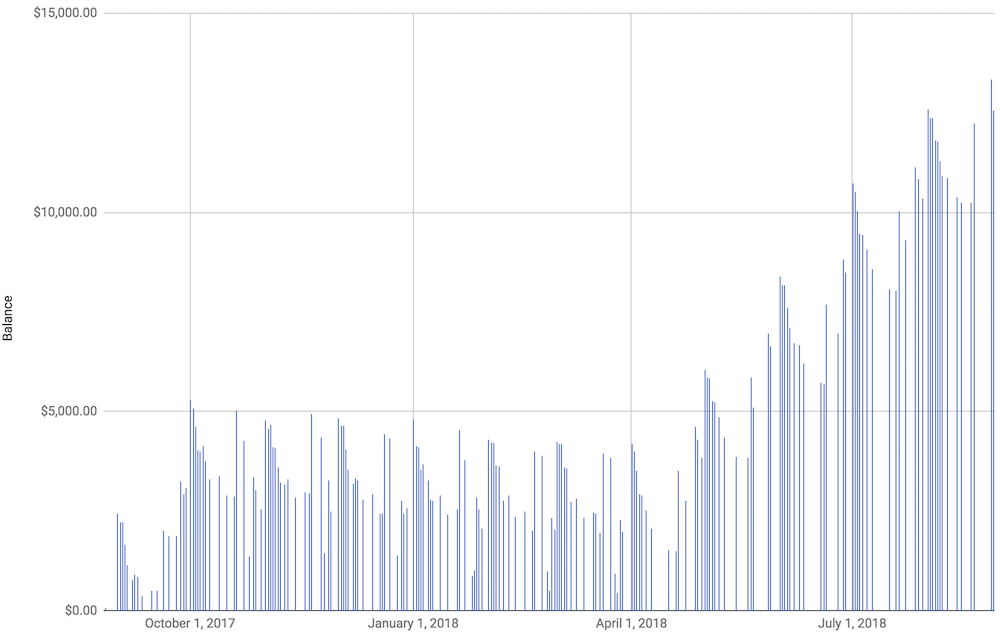

Here's what family #2's balance looks like with this modified plan:

Family 2: After a one-time deposit of $80 into the account, and reducing weekly expenses by $108.50 dollars/week for six months + extra $26.50 / week income for six months from extra hours

Once family #2 had the actionable information they needed they were easily able to go from a financial catastrophe to paying all their bills on time.

And the best part — family #2 didn't have to give up on anything!

They would be able to keep their current lifestyle, and after those six months could re-introduce all those small expenses and still meet their financial goals.

How Would You Like To Have All Your Expenses Covered While Spending Less Than Five Minutes A Week On Managing Your Finances?

Having a spending plan not only gives you the certainty that all your bills will be paid on time... It also sets you free from the time-consuming, stressful, tedious record-keeping that budgeting has you doing. Do you know what record keeping really is? Record keeping is the art of obsessing about the past. Think about it this way. Say you had $1500 in your account last week, and now you have $1000. Does it make any difference whatsoever whether you spent those $500 on groceries or on golf equipment? No, it doesn't. What does matter? The balance you have in your account today. The balance you'll have in your account tomorrow. That's what matters! And just like family #2, once you have a spending plan you can predict what those numbers will be... and make sure you meet all your needs and goals using what you have. Isn't that a huge relief? You can let go of the past — it doesn't matter anymore. Instead of spending hours updating your budget, all you have to do is follow a spending plan that takes into account your income and all your expenses for the next twelve months.

And That Only Takes 5 Minutes A Week!

Here's how you do it: Find today's date on your plan and see what your target is. Then go online and check your bank balance and compare the two. If you have more than the target — you can do whatever you like with the surplus (provided all the transactions in the plan are accounted for). If you have less, the shortfall has to be made up. (As you've seen - It's easy to do when you know six, seven, or ten months ahead of time that you'll be missing a few dollars.) And of course, if your current balance is the same as your target balance — then all is fine. No matter how long you've been struggling with money - months, years, even decades - this system can put an end to your struggles and money stress in no time. This system has been featured on national television in Australia on ‘A Current Affair' and ‘Today Tonight'. ‘Money Magazine' and ‘PC Authority Magazine' wrote about it more than once. I've been interviewed on ABC radio in Australia and in the USA about it. I've spoken on stage in the UK, USA, NZ, and Australia numerous times about this. But what matters the most to me are the letters I have received from helping over 30,000 people finally end their anxiety about money. Take a look:

“Our Spending Planner saved our family from financial ruin. She went above and beyond to guide us to making wise financial decisions.” - Krystle & Jason

“Your system has changed our lives. I have paid off my personal loans I had and only have $7k left on the $18k loan we had for my partner. Have also paid out credit card and have only $2k to pay off MasterCard (and we have 10k worth of savings!) ” - Hayley Summers, Pomona, QLD

“8 months ago I owed $4,200 on credit cards. I was at least one month behind on the Telstra bill and we never ever paid our rates on time. After your program, we have paid off our credit cards. We have just paid off the rates in full before the due date. Your program is the only thing that worked for me.” - Mary Sweet, Brisbane, QLD

“Two years ago I had personal loan of $7,500 I was struggling to pay. I was 2 months behind in my rates and credit card payments. Then I discovered your program so no more late fees or interest charges on the credit card.” - Annette Wisnewski, Mackay, QLD

“18 months ago something had to be done. We were living from pay to pay and we had a $9,200 credit card debt. Now I've paid all credit card debt and have savings of $10,000.” - Tamson Mayo, Norfolk Island

“This is the best bloody thing since sliced bread. We now know at ALL times exactly where our finances are now - and for the future. Once a fortnight we just dial up the ‘Spending Plan' and bang, it's all there in front of you. Bloody beauty mate.” - Harley and Sue

“After many years of budgeting in the past and wondering where the money went, we can now plan accurately for the future and know in advance where it will be going and most importantly what is going where. It's like having a finance “map of the future” to plan and make informed spending decisions before they arise.” - Malcolm

“I've been using the program for just on 12 months now and cannot believe the tremendous difference it has made to our finances. It's helped bring our finances under control and given us a very healthy surplus each month. As a result of the plan, we were able to buy a new car within the 1st year of using the program.” - Sasha

“I would like to say a big thank you to you personally as your program has been a total life changing experience for us. We have left behind us the debt and stress.” - Kyra Potts

“I would like you to know that I am $400 better off since I purchased your program 6 weeks ago. I am still trying to figure out where the money came from and how much have I wasted in the past?! This is the best investment I have made this year.” - John Kirk

“I am single mother of three with very little financial assistance other than working very hard in my own business. Through your program I have learnt how to manage my money better and have managed to save enough in the last 12 months to take my kids on a dream holiday. All 4 of us spent four weeks holidaying in Queensland and NSW (including the Gold Coast Theme parks) having the time of our lives. After a tense year it was what we needed to take time out as a happy family and renew our faith that ‘hard work pays off'. And it does indeed! ” - Jennie, Adelaide, SA

And I have hundreds more of these letters! But that's not the point. The only thing important right now is...

You Deserve A Life With Less Stress

If you feel you could probably manage your money a bit better... If you don't have a plan for the next twelve months and have not checked your “missing number” yet... Or if you still spend more than 5 minutes a week handling your finances... Then I urge you to have a Certified Spending Planner set a spending plan up for you. It has changed the life of over 30,000 people, and it will change yours too. Just ask yourself how you would feel if you could sleep like a baby again... Wake up relaxed... And know that all your finances are taken care of. You could finally afford that new house... New car... Pay back your debt... Or anything else that catches your fancy. Find a Certified Spending Planner today. Here's to your success and freedom!

Best wishes,

David

P.S. Through the story of Family #2, you have experienced the sheer power of working with a Certified Spending Planner. Can you imagine how many people out there are in need of this kind of service?

The Answer Is Easy... Almost Everyone!

There is literally an unlimited demand for Certified Spending Planners who can help people achieve their financial dreams. And it could be the key to your ultimate financial freedom. To find out more about becoming a Spending Planner, CLICK HERE

If you can take control of your spending, you'll put some breathing space between you and your money stress, allowing you to relax and start building a stable financial future for your family. If you just can't get your head around that and/or you are tired of money stress and have decided it's time to take control, talk to a Spending Planner to find out how you can break the cycle.

You have nothing to lose and lots to gain. Spending Planners are non-judgmental professionals who are trained to help. A short relationship with a Spending Planner will provide you with tools and training that will benefit you for the rest of your life!

Creating your own personal Spending Plan will be one of the best things you ever did.

Request a Call From The Spending Planners Institute 1300 918 450