Part 2: Repeating Predictable Expenses and How to Pay Them

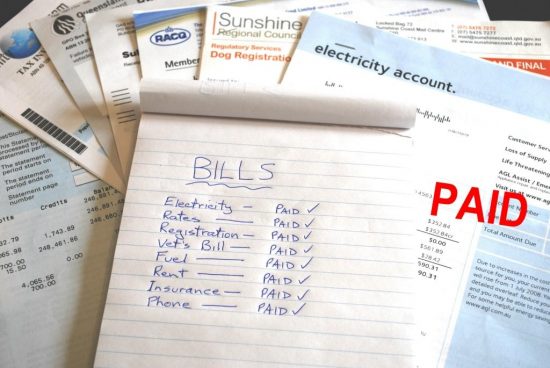

Repeating Predictable Expenses - (Otherwise known as ‘Bills'!)

These fall into two groups:

- Rent, Electricity, Telephone, Rates, Insurance, Planned Gifts, Regular Donations, Vehicle Registration, Memberships, Children's Lessons, Dentist and other similar expenses

- Mortgage(s) and/or Loan Repayments

These are payments or expenses you can reasonably predict into the future:

- You know how much they usually cost with reasonable accuracy or you can nominate an amount that will work for you more often than not

- You know how often they fall due within a yearly cycle

- You know when they will occur next

If you do not know these three facts about an expense, it does not belong in this list.

These kinds of expenses can be challenging for many of us. They can feel overwhelming, and at times it can feel like we don't know where the money is going. The good news is that these expenses are regular and predictable, making it easy to build a budget plan around them. In this article, I'll show you how to do that.

Where to Keep this Money

I recommend you open or identify a Bills Account to store this money in, and if you have a mortgage you might consider having it offset against the balance of your mortgage to save interest.

How to Manage this Money

It's pretty simple — you pay your planned bills from your Bills Account and ideally distribute funds from there to other accounts according to your budget plan.

For example, your weekly expenses money would be transferred out to your Day2Day account each week.

Your goals are to:

- Pay all of these predictable expenses on time

- Always have funds available when these expenses fall due (this does wonders for your stress levels!)

- Use as little of your income as possible in paying these expenses (you have better things to do with your income than pay bills!)

- Never have more savings put aside for these expenses than is necessary

The biggest reason people have difficulty with these expenses is that they have no plan and no targets to aim for.

To help you create your spending plan:

- Calculate the total cost of these predictable expenses for the year ahead

- Divide that total by the number of weeks (or pays) in the next year

You will then know what the 'per week' or ‘per pay' cost of these expenses is.

Looking Forward Is Essential!

Doing the above will give you a really good start, but to totally take control of these expenses and reduce money stress dramatically you then need to lay them out on a timeline and calculate your day by day target bank balances for the next year in advance. However you go about it you need to look into the future to generate your daily targets to aim for — that will make managing this group of expenses easy and stress-free! Not knowing how much needs to be in your Bills account on any given day of the year makes it very difficult to actually have the correct amount available. It is very easy to get caught out by bills arriving when you don't have a plan in place.

Success with Money

If you think success with money is for someone else, think again! You deserve it as much as anyone else and I have helped thousands of people achieve it, so why not you too? If you think taking control of your money is all too hard, get someone who teaches and uses my system to help you...go to www.findaspendingplanner.com.

You'll find trained Spending Planners who are extremely passionate about helping people there. The benefit will be far more than the cost and it will be with you for the rest of your life!

If you can take control of your spending by making some of the little changes above, you'll put some breathing space between you and your money stress, allowing you to relax and start building a stable financial future for your family. How many expenses do you accept in your day without question, and where could you reduce your weekly outgoing money just by changing a few habits? If you just can't get your head around that and/or you are tired of money stress and have decided it's time to take control, talk to a Spending Planner to find out how you can break the cycle - BOOK A FREE CALL

You have nothing to lose and lots to gain. Spending Planners are non-judgmental professionals who are trained to help. A short relationship with a Spending Planner will provide you with tools and training that will benefit you for the rest of your life!

To find out more about becoming a Spending Planner, CLICK HERE

Creating your own personal Spending Plan will be one of the best things you ever did.

Request a Call From The Spending Planners Institute 1300 918 450